‘How does the tax-paying record of large Australian companies square with our much-vaunted Australian egalitarian ethos?’ Honest History, 18 February 2018 updated

The ABC’s chief economics correspondent, Emma Alberici, this week put out some articles on the tax paid by some Australian companies.

There is no compelling evidence [said Ms Alberici] that giving the country’s biggest companies a tax cut sees that money passed on to workers in the form of higher wages … It’s also disingenuous to talk about a 30 per cent rate when so few companies pay anything like that thanks to tax legislation that allows them to avoid paying corporate tax. Exclusive analysis released by ABC today reveals one in five of Australia’s top companies has paid zero tax for the past three years … The overwhelming benefit of higher profits flows to shareholders.

The ABC is reviewing some of the content of one article (original version of the article) and has made some revisions to the other article (here). Revision of the original article.

In the same ball-park as Ms Alberici, though, the Australian Taxation Office said in December that 732 companies paid no tax in Australia in 2015-16. (Last week’s media release from the ATO.) The US Congressional Budget Office reckons Australia’s effective corporate tax rate is not 30 per cent but 10.4 per cent, one of the lowest in the world. Jim Killaly, former ATO senior official, has written at length about international tax shifting arrangements.

Ms Alberici’s work earned her a serve from the prime minister, who said hers was ‘one of the most confused and poorly researched articles I’ve seen on this topic’, because it misunderstood the roles of investment and risk in a capitalist system. (Others disagreed: Greg Jericho in Guardian Australia.) In November, the prime minister had said that the Royal Commission on banking ‘will not put capitalism on trial’. The corporate tax system, like the banking system, is a pillar of capitalism. However, we need to consider how a tax system that allows outcomes like those Ms Alberici described or the ATO identified – or a banking system that delivers massive profits to shareholders while letting customers down – squares with Australia’s egalitarian ethos.

The prime minister often enthuses about egalitarianism. As he said on Australia Day 2017,

here under the Southern Cross we have forged our own nation with unique Australian values – democratic and egalitarian. Deep in our DNA we know that everyone is entitled to a fair go in the great race of life. And that if you fall behind, we are happy to lend a helping hand to get ahead. This strong sense of justice springs from the solidarity, the mutual respect, the mateship that transcends and binds us together in our diversity.

And that is always when we are at our best and most Australian – the selfless sacrifice of the diggers a century ago, the courage of their descendants in the Middle East today. Volunteers fighting fires and floods, pulling kids out of a rip at the beach, rushing to the aid of the wounded on Bourke Street.

But companies paying minimal or no corporate tax (because they fail to make – or contrive not to make – the profits on which this tax is levied) contribute to inequality – and deny the egalitarian ethos – just as surely as do poverty-line social security payments, casualisation of employment, being Indigenous, remote areas’ lack of access to services, corporate boards paying massive bonuses to executives, shareholders reaping dividends while workers’ wages stagnate in real terms, rich families passing on assets from generation to generation, or any of the many other drivers of inequality. Gaming the tax system means there is less taxation revenue to spend on services for the benefit of all of us, particularly those who need these services most.

Over recent years Honest History has collected lots of resources on inequality and its causal factors. One of the themes of The Honest History Book, too, was the disparity between the Australian egalitarian ethos and our unequal reality. In her chapter in the book, academic and former politician, Carmen Lawrence, said this:

Today, the wealthiest 20 per cent of Australians own 61 per cent of the nation’s wealth, the poorest 20 per cent just one per cent. Although the income disparities are less marked, they too have been increasing. OECD data show that the richest ten per cent of Australians captured almost 50 per cent of the growth in gross domestic product (GDP) over the last three decades. A significant minority of citizens live in outright poverty, this figure being estimated by ACOSS in 2015 at approximately 12.8 per cent.

Other observers have pointed to similar statistics. The point, though, is to do what Lawrence does – set the statistics against the stories we tell ourselves. Lawrence concluded her chapter thus:

Are we really the nation of a “fair go” or are we kidding ourselves? In reality, it seems that our comforting and comfortable egalitarian myth, passed down to us in stories of brothers in the bush and mates in the trenches, is blinding us to the growing divide in our society and the need to do something about it.

Lawrence also politely pointed out that egalitarian values were not uniquely Australian but common to many Western liberal democracies.

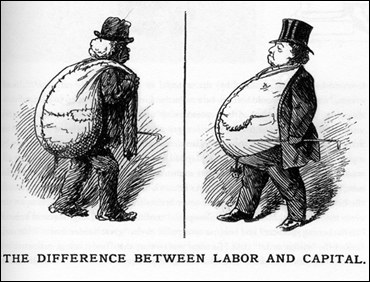

Anonymous cartoon, United States, 1887 (All the World Over)

Anonymous cartoon, United States, 1887 (All the World Over)