Inequality in Australia 2016

Inequality in Australia 2015

Inequality is not a personal choice – it’s a choice governments make (13 December 2017)

John Falzon of St Vincent de Paul writes in Guardian Australia:

We need a solid jobs plan, and full employment should be a policy priority. Instead we keep getting served up a putting-the-boot-into-the-unemployed-plan and a slashing-social-expenditure-plan. Behavioural approaches won’t fix structural problems. The government can blame people all they like but this won’t address the inequality many are burdened with, as wages are suppressed and profits soar, buttressed by tax cuts, wage cuts and social expenditure cuts.

Gender pay gaps a problem not just at the top of the scale (4 December 2017)

Roger Wilkins and Barbara Broadway in The Conversation on how gender helps drive inequality.

There are currently 122 federal awards, covering a variety of industries and occupations, and with each specifying numerous different minimums depending on things like the tasks and duties of the job and the qualifications and experience of the employee.

This, combined with the fact that men and women differ considerably in the types of jobs they do, means it is still possible for a gender pay gap to exist among minimum-wage workers.

Better news on gender pay inequality – but will it last? (20 November 2017)

Rebecca Cassells in The Conversation tracks a reduced gap between male and female pay rates, but suggests it is due to a shrinking economy rather than structural change. Includes some statistics going back more than 20 years.

The breaking up of social solidarity can be seen in many areas (9 November 2017)

Honest History distinguished supporter, John Menadue, writes on Pearls and Irritations about the growing social divide in health, education, housing, discrimination, and wages and incomes.

What the 2016 Census says about some drivers of inequality (25 October 2017 updated)

Nicholas Biddle and Frances Markham in The Conversation on how being Indigenous, a single parent, a new entrant to the the labour force, or (less so) on the verge of retirement sets you up nicely for falling behind in the economy we have today. From the Census with graphs.

Biddle backed up with a note on the Productivity Commission report (27 October 2017) on expenditure on Indigenous Australians – a report that suggests that the spending is not making a dent in Indigenous disadvantage.

Summary of main points from recent ACTU and HILDA reports, along with comments on recent books by Stiglitz, Atkinson and Schiedel (3 October 2017)

A handy article from Norman Abjorensen in the Public Sector Informant supplement to the Canberra Times. The author’s headline is something we have said before – often: ‘There is no shortage of policy “fixes”, but few governments are brave enough to try them’.

Inequality gap narrows a bit, thanks to incomes at top level – but Australian still lags in OECD terms; prison population (14 September 2017)

Peter Whiteford in Guardian Australia looks at the latest ABS statistics and finds ‘even with the slight reduction in inequality, we are slightly above the OECD average, and there are around 20 OECD countries who are likely to have lower levels of income inequality than Australia’. Discusses statistical issues also, with graphs.

Plus a handy link from The Briefing a couple of days ago to recent reports on Australia’s prison population – incarceration is a significant indicator of inequality and some of us are more likely to be in prison than others.

Australian intergenerational mobility less than previously understood (30 August 2017)

An aspect and driver of inequality is the potential of one generation to rise above the previous in terms of status, income and other indicators. A new study by Andrew Leigh MP and others suggests Australia is not as good at intergenerational mobility as we thought. The study used data on rare surnames among doctors and university graduates from 1870 to the present. ‘[T]he status of earlier Australians explains about half of the status of their descendants. The correlation has changed little over time.’

Unequal access to justice (30 August 2017)

Ross Gittins in Fairfax. Refers to Law Council of Australia work on access to justice and Productivity Commission report on the same subject.

What can governments do to make up for inherited inequality? (15 August 2017)

Rampino, Western and Tomaszewski in The Conversation on social mobility and inequality. Includes material on measurement difficulties.

[E]arly interventions (early in people’s lives, and early in the occurrence of potential major life problems), plus ongoing support, can reduce some of the inequality of opportunities. That’s especially if they are targeted at the critical points (such as childhood), where people’s opportunities can be particularly constrained by their background and other circumstances out of their control.

The country-city divide as a driver of inequality (12 August 2017)

Tim Colebatch in Inside Story on how country Australia’s employment decline is forcing young people into the cities. ‘Over the 2016–17 financial year, on average, Sydney had 62.9 per cent of its adult population in work; the rest of New South Wales had only 55.6 per cent. In Melbourne, 62.8 per cent of adults had jobs; in the rest of Victoria, 58.8 per cent.’ Colebatch also looks at wealth and income differentials.

Inequality still front and centre as Parliament resumes (8 August 2017 updated)

Jennifer Chesters in The Conversation focuses on wealth inequality. Ben Eltham in New Matilda looks at the current politics of inequality.

Chris Doucouliagos in The Conversation says: ‘Our study of 21 OECD countries over more than a 100 years shows income inequality actually restricts people from earning more, educating themselves and becoming entrepreneurs. That flows on to businesses who in turn invest less in things like plant and equipment.’ So, we all suffer.

On Pearls and Irritations, Ian McAuley and Michael Keating look closely at the need to raise more taxation revenue and how this will impact on inequality. Well-designed taxes can actually improve economic resource allocation and, if the additional revenue is spent on tackling inequality, this can increase economic growth.

Links to recent material on inequality (3 August 2017)

These dozen links indicate the complexity of inequality as an issue, both in its causes and its manifestations. The more that people read this material (and the relevant primary sources) for themselves, perhaps the less likely inequality will remain, for many Australians an issue hidden behind the comforting facade of however many quarters it is of economic growth. It has been hidden there for far too long.

Inequality to the fore with Shorten pitch on inequality; the end of neoliberalism? (21 July 2017 updated)

Opposition Leader Bill Shorten made a well-reported (The Monthly, Fairfax, Guardian Australia, Huffington Post) speech on inequality and how to fix it, especially through the tax system. He was interviewed on Insiders (video and transcript pending).

Inequality kills hope [Shorten said]. Inequality feeds the sense that the deck is stacked against ordinary people, that the fix is in and the deal is done … it fosters a sense of powerlessness that drives people away from the political mainstream … That’s why tackling inequality will be a defining mission for a Shorten Labor government.

In the same arena – the connection between government policies (and policy fashions) and the effects on people – Ross Gittins in Fairfax and Geoff Davies in Pearls and Irritations wrote about neoliberalism.

As no less an authority than The Economist magazine has judged, the “neoliberal consensus” has collapsed [argues Gittins]. For almost 40 years in the English-speaking economies, both sides of politics have accepted that businesses and individuals should be allowed to go about their affairs with as little restriction as possible. But now both sides are stepping back from that attitude, doing so under pressure from voters growing increasingly unhappy about the state of the economy – in Oz, low wage growth, high energy costs, a seeming epidemic of business lawlessness and a lengthening list of government outsourcing stuff-ups – and the special treatment accorded to business.

The great neoliberal experiment has been a resounding failure … The means to re-create the fair go are readily available [says Davies]. There is no magic in this, we just have to cut through a lot of misguided ideology. Not only can we have stronger families and healthier communities, we can nurture a healthy land and mitigate the big global challenges we face.

Treasurer Morrison reacts to Shorten speech. Comment from Greg Jericho in Guardian Australia. And Reserve Bank Governor Lowe on wealth inequality. Eva Cox in The Conversation with links to other material, including Australian Quarterly (mostly paywall).

The history of homelessness, which is a minor contributor to and indicator of inequality (19 July 2017)

Anne O’Brien and Heather Holst in The Conversation: taking the long view on homelessness.

How the weekend penalty rates change will exacerbate inequality (8 July 2017)

Lenore Taylor in Guardian Australia says:

In a world where increased profitability was shared between wages and profits, where executive pay was somewhere within the bounds of reasonable and where companies paid their due taxes, those advocating the penalty rate cuts might find traction for their main economic argument – that businesses might employ more workers on the weekends, or employ existing workers for longer shifts.

But we live in times where there is absolutely no reason to have such faith, where after 26 years of economic growth the share of national income going to Australian households is close to a 50-year low because most of the riches from the commodity boom went straight into the profits of businesses, where executive pay remains stratospheric and where we regularly read of big businesses that arrange their affairs to pay no company taxes at all.

What the 2016 Census tells us about income inequality across Australia (6 July 2017)

Nicholas Biddle and Francis Markham in The Conversation:

Australia … has a geographically concentrated income distribution, with the rich living in neighbourhoods with other rich people. The poor are also more likely to live in close proximity to people who share their disadvantage. If … the spatial segregation of high and low income households reinforces inequality across the generations, then policies that encourage the mixing of different social classes in the same neighbourhood and region should be a way forward.

Lessons about inequality can be drawn from our convict past (3 July 2017)

Laura Panza in The Conversation takes a historical look at the relations between labour scarcity, land abundance, emancipation of convicts, the pace of industrialisation, and other factors, to plot their collective impact on income inequality, which historically has been less in Australia than in the United States. The concepts are complex but the article is worth persisting with. This is its conclusion:

Income inequality in Australia has been rising since the mid-1990s. At the start of the 21st century, the income share of the richest 1% of Australians was higher than it had been at any point since 1951.

Greater equality obviously can’t be achieved by emancipating convicts now, but policymakers can mimic the same effect by targeting vulnerable segments of society that experience greater disadvantage. For example politicians could improve equality of access to health, education, housing and other services across the country.

Cassells, Duncan and Dockery look closely at educational inequality (26 June 2017)

A team from Curtin University discuss recent reports on equality in education which ‘demonstrate the need for education policies to go beyond funding reform and tackle the complex barriers that exist in delivering education to our most vulnerable children’. From The Conversation.

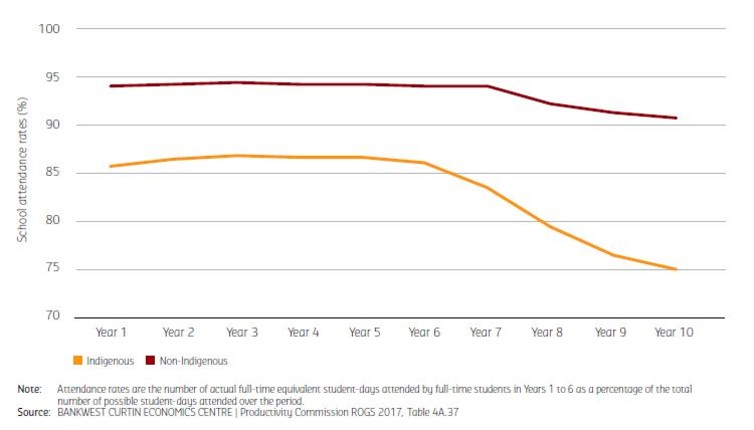

Student attendance rates, Years 1 to 10, by Indigenous status, 2016

Differential access to very fast broadband: the digital divide is another driver of inequality (22 June 2017)

Schram, Baum and others in The Conversation on this looming problem.

Another look at inequality figures (21 June 2017)

Roger Wilkins in The Conversation digs deep into the income inequality evidence and finds things are more complex than we thought. Three key Australian take-aways:

- The top 1% got richer, faster since the turn of the 21st century, but overall household income inequality has barely changed.

- Wage inequality has increased over this period.

- Wealth inequality has grown but is less now than in the years before the Global Financial Crisis.

GDP growth figures blow trumpets about records but there’s a strong undertone as well (7 June updated)

ABS figures on 103 successive quarters of growth but commentary emphasises there is a lot more to be said, with particular reference to inequality. Declining shares for wages and households are crucial drivers of inequality.

The Australian Financial Review‘s Rich List for 2017 (29 May 2017)

The list is analysed by Mike Head on the World Socialist Web Site. The growing inequality in Australia emerges clearly from this annual ritual of celebrity listing.

Taxation figures reveal some evidence about ‘middle Australia’ and gender inequality (19 April 2017)

Perceptive Guardian Australia article from Greg Jericho, with lots of graphs.

Automation and inequality (15 April 2017)

Jim Chalmers MP and businessman Mike Quigley in Guardian Australia on the potential contributions of automation to inequality. Their book is out in September.

They believe technological change can make inequality even worse in Australia if it is left unattended. It can skew power relations for ordinary people at work, and have consequences for wages and employment conditions. They say there’s no such thing as “technological trickle-down,” because economic gains from artificial intelligence, automation, machine learning and robotics “will not share themselves naturally”.

Non-taxation of ‘rich list’ Australians (12 April 2017)

Forty-eight Australians who earned more than $1 million each in 2014-15 paid no tax; Gareth Hutchens in Guardian Australia reports on tax office data.

Non-taxation of companies in Australia (11 April 2017)

The Conversation Factcheck on claim by the ACTU’s Sally McManus that 679 companies pay no tax; finds the claim pretty much spot on.

Penalty rate restructuring will increase inequality: Bernie Fraser (7 April 2017)

Former Reserve Bank governor and Commonwealth Treasury secretary, Bernie Fraser, is reported on the links between interfering with penalty rates and inequality in the community.

Spatial inequality is part of the mix, too (31 March 2017)

Bruce Bradbury in The Conversation looks at the links between where people live and their income. Graphs show the share of city-level inequality associated with location (capital cities) has grown over the period since 1991. There are also maps of inequality across Sydney and Melbourne. Good to-and-fro between the author and commenters, which there should be more of generally.

Youth underemployment is an important contributor to inequality (27 March 2017)

A Brotherhood of St Laurence report pinpoints some worrying statistics about the extent of youth underemployment (at 18 per cent of the youth labor force, its highest level for 40 years) and its implications.

Singer Jimmy Barnes supports the Brotherhood’s campaign on youth underemployment (The Brotherhood)

Singer Jimmy Barnes supports the Brotherhood’s campaign on youth underemployment (The Brotherhood)

Government statement on multiculturalism focuses on diversity, ‘fair go’ and equality as values but what is the reality? (20 March 2017)

This post contrasts government claims that Australia values both diversity and equality of opportunity with evidence in The Honest History Book that Australia is still heavily Anglo-Celtic and that inequality is growing.

Then and now: hours of work, work-life balance and the role of unions – aspects of the struggle against inequality (16 March 2017)

Compare and contrast: an article from the IWW newspaper, Direct Action, 100 years ago this week; statements this week by Senator Di Natale and new ACTU secretary McManus.

Why corporate Australia should care about inequality; welfare myths (10 March 2017)

Andrew Leigh MP speaks to the Minerals Council; Peter Whiteford of ANU on ‘the enduring power of welfare myths’. Leigh says corporate Australia should care about inequality for these reasons: inequality means less wellbeing; high levels of inequality lead to instability; ‘more unequal societies tend to be less socially mobile’. ‘Despite the evidence that deliberate fraud is a tiny fraction of social security spending’, says Whiteford, ‘it remains a mainstay of much reporting of welfare in the Australian media’.

Wayne Swan on inequality as a neglected political issue; economic abuse as a cause of inequality (2 March 2017)

Former Treasurer Swan on RN says Labor must ‘do more to address what he sees as the mounting discontent in the community to politics as normal. His advice—Labor needs to put rising inequality at the heart of its agenda for the next federal election. That includes a “thorough” consideration of the so called Buffett rule, where wealthy Australians would be slugged a mandated minimum rate of income tax.’

Kutin, Read and Russell from RMIT University discuss research that shows ‘disability, health status and financial stress were significantly associated with economic abuse, especially for women’.

Economic abuse is a hidden form of intimate partner abuse. Victims are often unaware it is happening – until they are in the process of separation and divorce, or are experiencing severe financial stress. Economic abuse occurs between intimate partners when one controls or manipulates the other person’s access to finances, assets and decision-making to create dependence and control … Victims are unlikely to see themselves as victims, and are unlikely to identify with domestic violence services or websites unless other forms of abuse are occurring.

Job creation and economic equality should be Left targets; mothers need basic income (27 February 2017)

Andrew Scott in New Matilda says populist politicians like Trump will do well with ‘a crucial former Left constituency until the Left-of-centre parties return to their traditionally strong focus on jobs and economic equality’. Also in New Matilda, Petra Bueskens argues that a basic income for mothers should be a policy priority.

Big cities as engines of inequality (24 February 2017)

Somwrita Sarkar, Peter Phibbs and Roderick Simpson of the University of Sydney write in The Conversation about how income inequality has increased as our cities have grown. ‘We propose a solution: rather than concentrate activity around a single city centre, we need to develop multiple centres of activity – polycentric cities.’

CEO salaries and Australian inequality (10, 17 February 2017)

Carl Rhodes of UTS on what the disclosed salary package of Australia Post CEO, Ahmed Fahour, says about attitudes to equality in Australia today. From The Conversation. Nick Dyrenfurth in Guardian Australia says self-regulation doesn’t cut it as a way of controlling executive salaries.

In the land of the ‘fair go’ not everyone gets equal slices of the pie (27 January 2017)

Nicholas Barry in one of The Conversation‘s Australian identity pieces marking Australia Day. (Another was by Frank Bongiorno, but they all link from here.) Looks at recent political rhetoric and at what might qualify as a ‘fair go’.

So although politicians claim to place a great deal of importance on the idea of the fair go, there are still significant ways in which Australian society seems to depart from this idea. Given the reforms the Coalition tried to get through (for the most part unsuccessfully) in the 2014 budget, and the recent scandal over Centrelink, it seems likely that the “fair go” will continue to be under political pressure in the years to come, whatever the rhetoric.

Attracted 309 comments.

Oxfam report reiterates earlier data about the extent of inequality (16 January 2017)

Guardian Australia report summarises latest data from Oxfam (with link to the full report):

Australia’s two richest people, Gina Rinehart and Harry Triguboff, own more than the poorest 20% of the country’s population, research has found.

Worth an estimated combined $21.5bn ($US16.1bn), the nation’s richest woman and the Meriton property boss are among the wealthiest 1% of Australians, who together own more than the bottom 70%, the report from Oxfam found …

Globally, the richest eight people – including the founder of Microsoft, Bill Gates, and Facebook’s Mark Zuckerberg – own as much as the poorest half of the world’s population, or about 3.6bn people.

“Collectively, the world’s richest eight men have a net wealth of $US426bn [$A568bn],” [Oxfam Australia chief executive, Helen] Szoke said. “Such an extreme divide between the rich and the rest risks plunging future generations into political instability, undermining our democratic institutions and creating economic upheaval.”

More from Helen Szoke. Nick Beams on the World Socialist Web Site. Factcheck from Peter Whiteford on The Conversation. David Ruccio on the Real World Economics Review blog.

Gina Rinehart (Guardian Australia/AAP)

Gina Rinehart (Guardian Australia/AAP)